In my previous post, I listed the credit cards I have applied for and been approved for in 2015. In this post I will explain the value of credit card applications I have submitted over the past year.

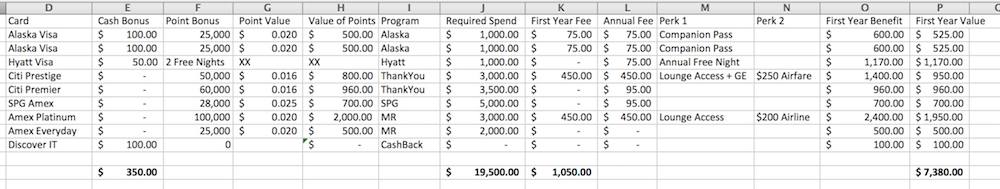

Here is a spread sheet I created that shows the details of each card. Prepare yourself for some brain numbing calculations…

First, the cost of the credit card applications.

Some credit cards have annual fees. Of the cards I applied for, the annual fees ranged from nothing (Discover IT and Amex Everyday) to $450 (Prestige and Amex Platinum) as shown in column L above. In addition, some of the credit cards waive their first year fee (column K).

I paid a total of $1,050 in annual fees this year for the 9 credit cards I applied and was approved for.

This was offset by cash back sign up bonuses for some cards that totaled $350 (column E).

Out of pocket, I paid $700 for these 9 cards.

In addition most of the cards have a minimum spend (column J) required to get the sign up bonus. In total, I had to charge $19,500 in total for all of my cards. This takes time and planning.

How did I meet minimum spends?

About half of my minimum spend was met through my normal spend habits. Any time I make a purchase, I put it on a credit card.

I tend to steer clear of “manufactured spend“. In short, manufactured spend is purchasing Visa gift cards (for example) and then liquidating them through various means such as the Amex Serve card. Where I live there are no nearby Walmart or Family Dollar locations; the two places that most people use for liquidating their gift cards. Others like to use money orders but those also scare me as there are questions around legality and bank rules surrounding this practice. Googling “manufactured spend” will help if you are wanting to learn more about this practice.

A note on retail arbitrage

The other half of meeting my minimum spend was done through reselling products through Fulfillment By Amazon (FBA), also known as “retail arbitrage“. Note: This can be a bit of a gamble. There are ways to minimize your risk, but I am not a financial, legal or tax expert. This is just my experience and is not meant as advice.

The goal of retail arbitrage is to purchase a product at once price using your credit card and then resell it at a higher price to break even (or even make a few dollars). In doing so you can quickly meet your minimum spend purchasing items that you then flip and resell.

When you couple it with coupons, sales, store loyalty programs, etc you can actually make some money.

Here is an example of reselling a “widget” that normally retails for $500.

An office supply store runs an ad for $150 off the widget. With sales tax (nearly 10% in WA State), the widget costs me a total of $382. I purchase the widget online through the use of a portal, meaning I get 3% cash back on the purchase (about $10). In addition, the office supply store has their own loyalty program where I get 5% back on my purchase ($17) in rewards I can use for a future purchase. So for the widget I am out of pocket about $354 but I have put $382 on a new credit card that counts towards my minimum spend requirement.

$350 + tax = $382 – 3% cash back through a portal – 5% back through store rewards = $354 cost

Now, the widget sells for $431 on Amazon. I ship it to FBA for about $4 and Amazon charges me $27 to list and sell it. I price it competitively and it sells immediately. Amazon then deposits the sale price minus shipping and listing fee into my bank account — a total of about $400.

$431 sale price – shipping – FBA fee = $400

After all is said and done, I have made profit of $46 and met $382 in minimum spend.

There is risk involved. The widget might not sell for what I had hoped it would. The buyer may decide to return the widget after he/she opens it and I can no longer sell the widget as new. There are questions about collecting sales tax on Amazon sales. It also takes time to purchase, ship and monitor the widget.

My retail arbitrage over the past 9 months has allowed me to spend over $8,000 on my new credit cards to meet the minimum spend requirements. I have been lucky and have been able to make a net profit of $886 on the sale of these items.

Value of Credit Card Applications

So now that I have met my minimum spend requirements, what is the value of the sign up bonuses I was able to earn?

Column F shows the sign up bonuses for each card. To calculate how much each sign up bonus is worth, I based my point value (column G) on The Points Guy’s valuation. The Hyatt Visa did not give points but instead gave 2 free nights that I am using at the Park Hyatt Buenos Aires. Each night during my stay is $585 so I value my sign up bonus as $1,170.

For the two premium cards (Amex Platinum and Citi Prestige), a bonus perk was included (column N) that I was able to use twice during my first year with the card (once in 2015 and again in 2016 before my annual fee is due) so I included those in the value of the card. I also received a $100 credit towards Global Entry with the Prestige card so included that in the benefit as well.

The value of lounge access is highly debatable so I did NOT include it in my value of the card. I also didn’t include the Alaska Airlines Companion Pass value since it is so dependent on the ticket cost.

Column O shows the value of the card benefit in the first year of owning the card. I subtracted the first year annual fee (column K) from the benefit to get column P, the value of the first year with the card.

While the point value may be a bit of a stretch, I actually think my overall valuations are conservative. However, the value I calculated isn’t the same as money in my pocked. For example, had I not earned the two free nights through the Hyatt Visa, I would not have planned a trip to Argentina at a hotel that costs $500+ per night. Credit card sign up bonuses allow me to travel in luxury to places and in ways I wouldn’t be able to otherwise. It isn’t a way to make money, it is a way to facilitate travel; my ultimate goal.

The value of credit card applications this year in my calculations is over $7,000 in travel credit.